How Regional and Community Banks Can Leverage Local SEO to Gain Marketshare

Key Takeaways: SEO for Banks in 2025

- Regional and community banks face rising competition from national giants and fintech disruptors.

- Local SEO and Artificial Intelligence Optimization (AIO) help banks win location-specific searches and AI-powered search results. Leading to an increase in foot traffic, account openings, and commercial loan activity.

- This article highlights 3 tips to enhance local SEO for banks

- Download the full SEO for Banks Guide to get:

- 8 advanced SEO tactics

- 6 Google Ads strategies for high-intent leads

- AIO and Technical SEO tips to future-proof your bank’s digital marketing strategy

Table of Contents

ToggleRegional and community banks are navigating unprecedented competitive pressure on two fronts:

- National banking giants deploying billion-dollar marketing budgets

- Nimble fintech challengers capturing the loyalty of digital-native customers

Consider this: in 2024, JPMorgan Chase alone spent $4.88 billion[i] on marketing. Deloitte’s Digital Banking Maturity[ii] study shows nearly every large institution is racing to upgrade mobile and online experiences. KPMG’s 2025 survey confirms this trend, with 95% of banks increasing investment in digital platforms and 91% funding data-driven personalization[iii] to deepen customer relationships.

For marketing leaders, competing in a digital-first world is no longer optional, it’s one of the key foundations for growth. The good news? Your institutions hold an inherent advantage.

Unlike national players chasing broad audiences, your banks are uniquely positioned to win locally. With deep community ties and reputations for personalized service, you can leverage local SEO, hyper-targeted Google Ads, and Artificial Intelligence Optimization (AIO) to capture high-intent, geographically relevant prospects, at a fraction of the cost of national campaigns.

This article outlines proven strategies to help you thrive in today’s hyper competitive, AI-driven, digital-first environment.

But first….

What Is SEO and AIO? And Why Does It Matter for You?

Search Engine Optimization (SEO) enhances your digital presence, so potential clients find your institution during online searches. Local SEO, for banks, enables you to secure visibility in:

- “Near me” searches

- Google Maps results

- Geo-specific queries like “business banking in Springfield”

Unlike national banks vying for ultra-competitive terms like “checking account”, you can dominate location-specific searches such as “home loans near downtown Portland” or “business banking Oak Park.”

Artificial Intelligence Optimization (AIO), refers to the practice of tailoring your digital content and strategy to perform well within AI-driven search experiences, like Google’s AI Overviews, ChatGPT, Perplexity, and Gemini.

AIO is becoming increasingly more important. Users are doing more research via Large Language Models (LLMs) leading to lower click through rates from google searches, but they have much higher intent. Visitors from AI-enhanced search engine results, scroll deeper, stay longer, and convert better. This doesn’t mean that SEO is dead, quite the contrary, leveraging optimal SEO foundations will translate to greater visibility for AI tools.

Ranking higher means your institution captures more high-intent prospects at key decision moments, translating into increased brand trust, stronger engagement, and measurable growth.

If you haven’t already optimized your website and marketing for AI search tools you run the risk of falling behind rapidly.

Local SEO for Banks: 3 Tips to Enhance Local Search Visibility

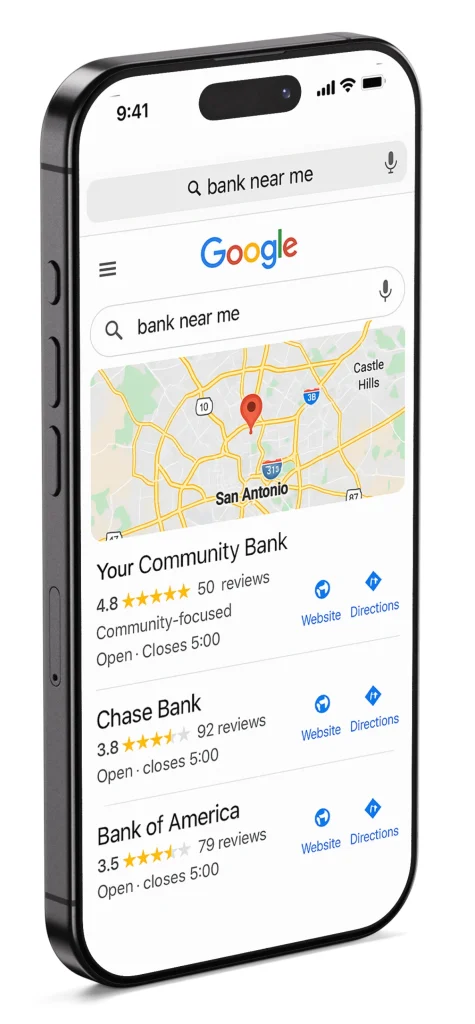

1. Optimize Your Google Business Profiles

Why It Matters

Your Google Business Profile is the single most important piece of real estate in local search and Google Maps. For many prospective customers, it’s the first thing they see when they search for your bank or a financial product in their area. If it’s incomplete, outdated, or inconsistent, you’re leaving room for competitors to take your place in the map results and in the customer’s mind. Optimizing your GBP is one of the key steps to ensure you show up first in Google’s Map Pack, reaching high intent targets when they need your service the most.

Action Steps

- Claim and verify each branch profile so you have full control over how your bank appears in Google Search and Maps.

- Fill out every available field; from branch hours and services to categories and accessibility features, using language that’s accurate, compliant, and customer friendly.

- Refresh your photos regularly with high-quality images of your branch exterior, interior, and team to keep your profile active and appealing.

- Post updates on Google about rate specials, community events, or educational content, ensuring each post passes compliance review.

- Add structured data (schema) to your branch web pages so Google and AI search tools like ChatGPT or Gemini can easily match your website to your profile.

- Track profile activity – calls, clicks, and direction requests, to measure how GBP is driving customer engagement.

Example

A multi-branch Midwest bank builds a consistent GBP presence across all locations, adds fresh images every quarter, and posts compliance-approved updates weekly. Over time, the bank begins consistently appearing in the top three map results for its priority local searches.

Common Pitfalls

- Inconsistent name, address, and phone details across directories.

- Keyword stuffing the business name, which can result in penalties.

- Forgetting to update hours for holidays or unexpected closures.

- Not answering customer questions posted in the GBP Q&A section.

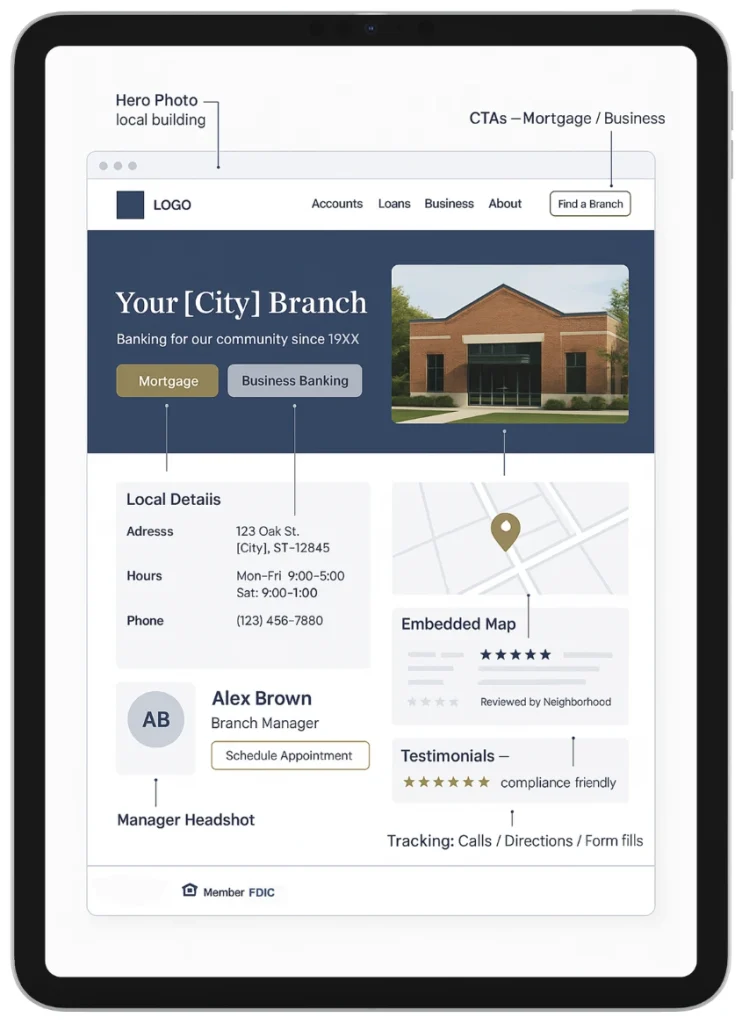

2. Create Location-Specific Landing Pages

Why It Matters

When someone searches for “mortgage lender near me” or “business banking in [City],” Google is more likely to show a page that’s clearly relevant to that location. A dedicated page for each branch tells both customers and search engines that your bank is active and invested in that community. Making it easier to rank higher and convert local traffic into real business.

Action Steps

- Create a dedicated page for each branch with unique information. Not just a copy-paste from other locations.

- Include local details like branch manager bios, photos of the team, and community involvement highlights.

- Embed a Google Map so customers can easily find you and Google can confirm your location.

- Feature branch-specific testimonials that have been cleared through compliance, providing social proof from local customers.

- Link directly to key products relevant in that market (e.g., mortgages in growing suburbs, business banking in commercial districts).

- Ensure mobile friendliness so the page loads quickly and is easy to navigate on a phone.

- Set up tracking to measure calls, form fills, and appointments coming from each page.

Example

A New England community bank builds unique pages for each of its 14 branches, highlighting local staff, photos, and community programs. These pages become highly visible in local searches and begin driving more inquiries from customers in each branch’s immediate area.

Common Pitfalls

- Reusing the same generic copy across all branch pages.

- Not optimizing the page for mobile devices.

- Hiding the page deep on the website instead of linking it from the main navigation.

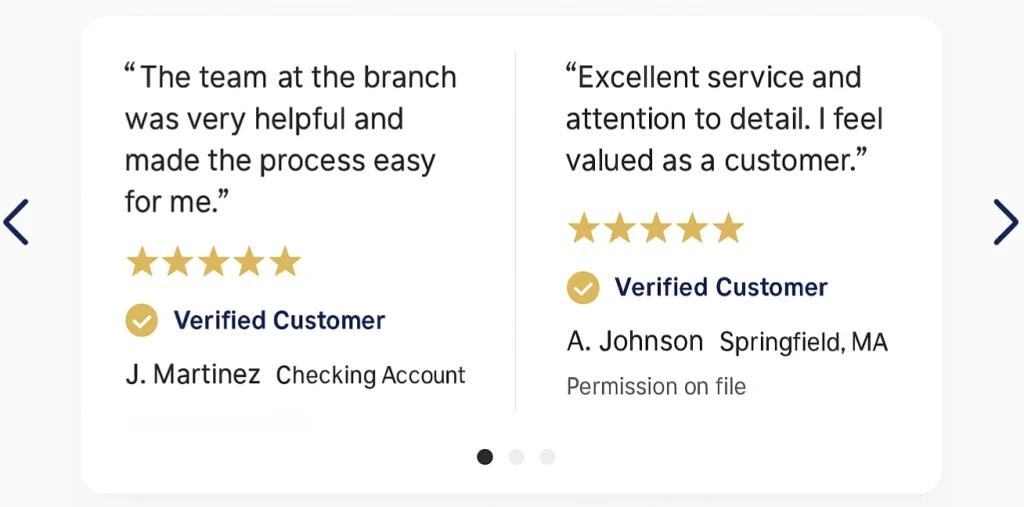

3. Manage Reviews Proactively

Why It Matters

Online reviews are now a major trust signal for both customers and search engines. In banking, where decisions carry high financial stakes, a strong, well-managed review profile can make the difference between being considered or overlooked. Reviews also directly influence where your bank appears in local search results, influencing whether customers choose you over a competitor.

Action Steps

- Implement an automated process for requesting reviews after key customer interactions, such as loan closings or account openings.

- Respond to every review, positive or negative, within 48 hours, following a compliance-approved script.

- Track and analyze review sentiment over time to identify patterns that may indicate operational issues or strengths.

- Highlight positive reviews (with customer permission) on your website, social media, or marketing materials.

- Coordinate with compliance to ensure all responses avoid unverified claims or prohibited language.

Example

A Southeastern regional bank sets up an automated post-service review request system and develops approved response protocols. Within months, its average Google rating improves, and search visibility increases for competitive local queries.

Common Pitfalls

- Only requesting reviews from select customers, which may raise compliance concerns.

- Posting fake or incentivized reviews, risking public trust and penalties.

- Ignoring recurring themes in negative reviews, allowing problems to persist.

These are a few strategies that will get you on your way to optimizing your online footprint. For an extensive guide.

Download “SEO for Banks: Unlock the Power of Local Search” and get:

– 5 additional advanced SEO tactics

– 6 Google Ads strategies for high-intent leads

– AIO and Technical SEO tips to future-proof your bank’s marketing

Let’s make your bank the obvious choice.

We specialize in SEO services for banks. Turn nearby searches into calls, visits, and applications.

SEO for Banks is the process of improving your bank’s digital presence so prospective customers can find you in search engines at key decision moments. It includes on-page optimization, technical SEO, content strategy, and authority building, tailored to regulated financial products and multi-branch realities.

Local SEO for banks focuses on location-based visibility. Think Google Maps, “near me” searches, and geo-specific queries like “business banking in [City].” It prioritizes branch-level accuracy (hours, services, NAP consistency), Google Business Profiles, localized content, and reviews. So each branch is discoverable to nearby customers with high intent.

AI search experiences (e.g., AI Overviews, ChatGPT, Perplexity, Gemini) increasingly shape how people research banks. AIO ensures your content is structured, trustworthy, and easy for AI systems to reference so your institution shows up when prospects ask nuanced, intent-rich questions about accounts, mortgages, or business banking.

Typical timelines are 3–6 months for meaningful traction, depending on your starting point, competition, and resourcing. Local signals (GBP optimization, reviews, and branch pages) often move first; broader organic growth compounds with consistent content, technical fixes, and authority building.

For most regional and community banks:

– Google Business Profiles – for every branch (fully completed, verified, and kept current)

– Location-specific landing pages – unique content per branch, with maps, staff, services, and CTAs

– Review management compliance-approved requests and responses, consistently executed

These three foundations usually deliver the fastest local lift.

Yes. A dedicated, unique page per branch clarifies relevance for city/neighborhood queries and converts better. Include manager bios, local photos, embedded maps, accessible hours, offered services, and branch-specific CTAs. Avoid copy-pasting the same content across locations.

Complete, consistent GBPs are critical for Map Pack visibility. Accuracy (name, address, phone, categories), fresh photos, timely posts, Q&A responses, and steady review activity all reinforce local relevance and trust. Keep holiday hours updated and monitor insights (calls, website clicks, directions).

Use a compliance-approved process to request reviews after key interactions (e.g., account opening, loan closing) and respond to all reviews, positive and negative, without discussing account specifics or making unverified claims. Never post fake or incentivized reviews. Track themes to inform service improvements.

Tie KPIs to business outcomes:

– Visibility & engagement: impressions, Map Pack rankings, GBP actions, organic traffic

– Conversion: tracked calls, appointments, form fills, account openings, funded loans

– Quality: local landing-page conversion rates, review sentiment, assisted conversions from organic and Maps

Ensure analytics can attribute results to branch-level pages and GBPs.

SEO builds durable, compounding visibility; PPC (Google Ads, LinkedIn, etc.) captures demand immediately. Most banks do best with a hybrid plan: invest in SEO foundations for sustainable growth and use paid media to fill gaps, test messaging, and accelerate high-intent campaigns.

– Mobile experience & site speed (especially on location pages and product pages)

– Structured data (schema) to clarify branches, reviews, FAQs, and products

– Crawlability & indexation (clean sitemaps, no duplicate location content)

– Accessibility (ADA/WCAG) and clear disclosures

– Security (HTTPS, robust privacy statements), which reinforces trust signals

Centralize your location data (source of truth), sync it to major directories, and assign governance for updates (openings, closures, hours, amenities). Standardize naming conventions and categories, and audit regularly to prevent drift. Automate where possible, but keep human QA for compliance and accuracy.

Absolutely. Create targeted pages and resources for business segments (e.g., dental practices, contractors, local retailers), highlight relevant services (treasury management, merchant services, lines of credit), and publish localized case studies and FAQs that speak to their workflows and timelines.

Audit your current visibility, fix the fundamentals (GBPs, branch pages, reviews), and stand up a measurement framework tied to appointments, calls, and applications. From there, expand into consistent content publishing, technical enhancements, and AIO to future-proof your search presence.